Overview

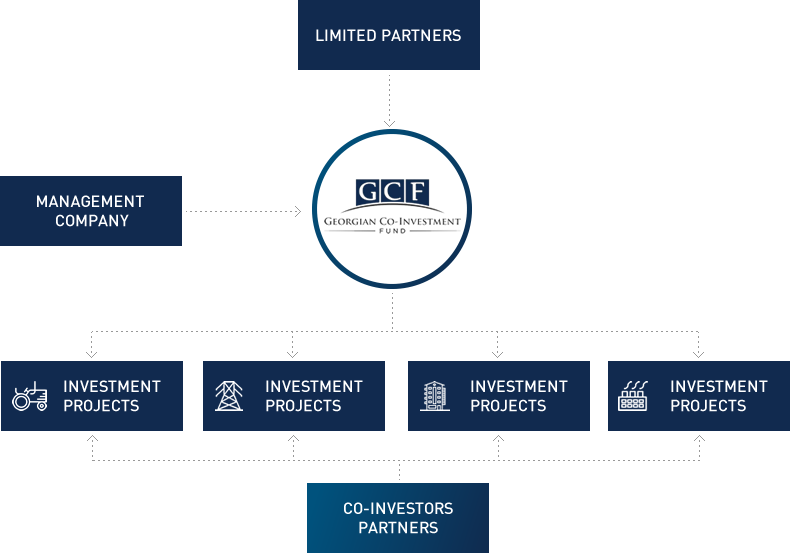

The Georgian Co-Investment Fund provides investors with exposure to the fast-growing sectors of Georgian economy. It utilizes a private equity structure designed to cater investors diverse needs.

Established in 2013, the Fund considers investment opportunities across sectors and industries which significantly contribute to the development of the Georgian economy, including Energy and Infrastructure, Hospitality and Real Estate, Agriculture and Logistics, and Manufacturing.

The Fund is currently managing assets in excess of US$2 billion.

The Fund will consider investments in both Greenfield and Brownfield projects as well as in distressed companies.

The Fund’s minimum IRR threshold for investment in projects is 17% and it intends to invest 25 – 75% of the total equity investment, with a minimum size of USD$5m.

The Fund is expected to retain its ownership interest in the Portfolio Companies for up to seven years, extendable to a maximum of nine. During that period the Fund will exit from its investments through sale of its ownership interest through any of the following routes:

- Sale to existing co-owners or partners of the project;

- Sale to external third parties;

- IPO on local and international stock exchanges.

Fund's Structure: